Your IRS tax return transcript could come in handy for various reasons, including applying for mortgage or student loans, verifying employment or keeping personal income records.

To quickly obtain a transcript, create an online account on the IRS website and download your transcript as a PDF file – it’s free and safe!

What is a Tax Return Transcript?

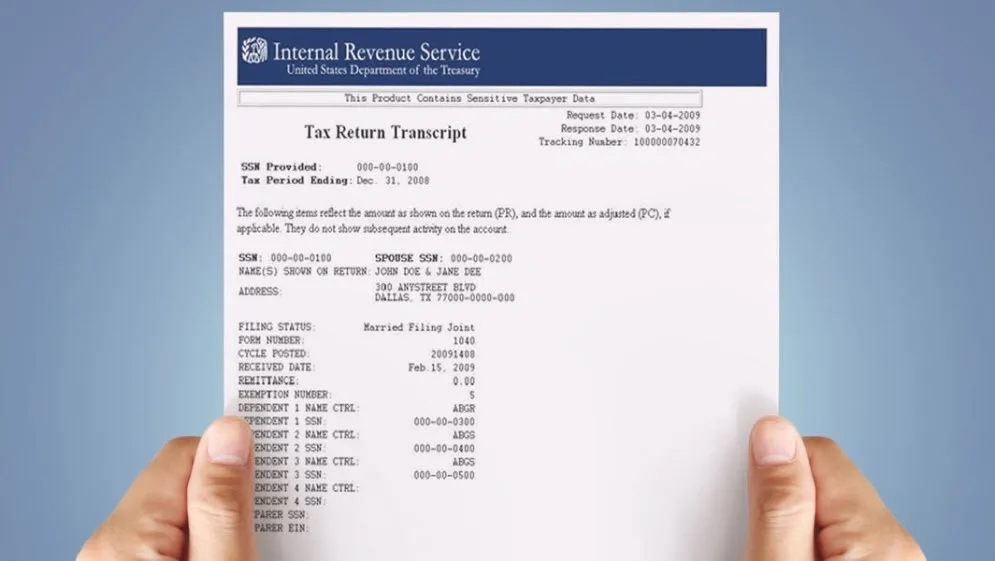

IRS transcripts come in five varieties, each providing a summary of specific items from your tax return. However, each transcript differs in regards to how much personal data it displays – with some only partially masking your financial data for privacy concerns while others providing full personal data so companies or institutions can use it for tax preparation, income verification or other services.

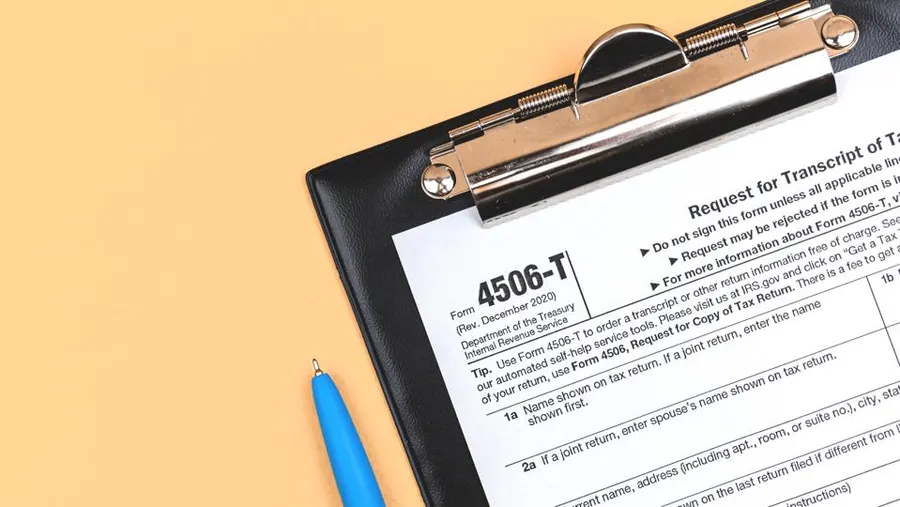

Tax return transcripts are copies of your original Form 1040 return and any accompanying forms you submitted, showing most line items from that original return, such as AGI (adjusted gross income), but without reflecting changes made via amended filing. They can be requested online or using Form 4506-T, transportation including for current year as well as up to three prior years.

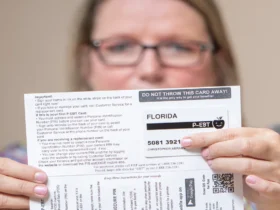

Usually, this kind of transcript will be required when applying for loans, jobs or federal benefits such as public health care programs. Colleges often request it when submitting FAFSA applications.

Ordering a tax return transcript requires both the SSN or ITIN and date of birth of the tax filer, along with their most recent tax year reported on either their most recent tax return or FAFSA application. Ordering is easy either online or over the phone – with instantaneous orders online available instantly while phone requests take 5-10 days – the transcript must then be delivered directly to their address on file with the IRS.

How Do I Get a Tax Return Transcript?

There are multiple ways to request an IRS transcript, with online services being the fastest. If using these online services is the quickest method for you, then validation must take place by providing information such as your social security number, date of birth and last four digits of street address listed on your tax return; either entering a code sent via text message or answering series of questions will suffice; otherwise the IRS requires written request instead.

For those unable to validate their identity online or who require transcripts for previous years, the IRS website also offers other solutions. You may request either a wage and income transcript (limited to approximately 85 income documents) or record of account transcript (combined tax return and account transcript above) using Get Transcript Online or Form 4506-T services.

When visiting an IRS office to collect your transcript, photo ID is required. Transcripts may not always be available so always double-check with the office you visit for more information. It should also be noted that the IRS never reaches out via email or text messaging to request personal or financial data; should such contact occur, report it immediately via Report Phishing.

What Should I Include in My Transcript Request?

The IRS offers five types of transcripts to assist in verifying financial and tax-related information. Each transcript summarizes your data while partially displaying personal details to protect privacy.

Record of Account Transcript is the most in-depth transcript available, providing a summary of every line item from your tax return as filed, such as filing status, marital status, adjusted gross income (AGI), and taxable income. Lenders for mortgage loans as well as those seeking financial aid for school often request this transcript.

Other transcripts available to taxpayers are Wage and Income Transcript, which provides details from forms W-2, 1098 and IRA contributions; typically this transcript is used by mortgage lenders for employment verification. Finally, Verification of Non-Filing Letter is another useful tool to verify if you filed in certain years but did not file.

IRS transcripts may come in handy if you need to resolve an issue or dispute with them, as evidence supporting your case. Keep in mind, however, that the IRS does not fax or mail transcripts directly to third parties – those looking for transcripts should use either Get Transcript online service or submit Form 4506-T so your transcript arrives quickly at its intended destination address.

How Long Will It Take to Get a Transcript?

As many reasons as there may be for needing a transcript of one’s tax information, such as being misplaced or lost digital files being corrupted or confusing IRS notices and correspondence, having one available can be invaluable.

Online transcript requests can be the fastest and simplest way to receive one quickly, simply requiring an electronic or faxed request from either tax filer (or spouse in joint returns) containing their social security number and date of birth for identity verification. Once processed, the transcript will be mailed directly to their address on file.

Usually, electronic and paper filings of taxes should receive their most current transcript within 10 days; however, if any outstanding debt exists with the IRS this transcript may take longer to arrive due to processes needed for paying it off. This does not fall upon them but must come from them voluntarily to clear any outstanding balances.

Tax return transcripts provide most line items from an original filing submitted by an individual or their representative, while record of account transcripts combine tax return transcript and wage and income transcript information into one report. Wage and income transcripts display information from information returns such as Forms W-2, 1098, 1099 or 5498.

Leave a Reply